The chart above is of CRUDE OIL futures, it seems evident that we are back in a bearish impulse since the 2011 high as with many commodities, notice the divergence on the RSI as prices where rallying into the 2011 high, we have tested the 0-B trendline and currently are coming off of it, ig you look closely you'll also notice that we have a potential head and shoulders top analgous to the one on the USD/CAD in early May,

The head and shoulders chart is reposted here again in order to illustrate the resemblence.

Above is an updated chart of the USD/CAD the latest bounce broke through the most conservative trendline drawn on this chart whcih supports the idea of an intermediate wave (2) bottom in place, targets are well above the 2011 high, as the wave structure unfolds and perhaps breaks the neckline on the head and shoulders pattern posted above we'll obtain more accurate targets.

Posted above is the CAD futures COT data, during early May sentiment reached an extreme with CAD bulls exceeding the 80% mark as highlighted above and the commercials reached a bearish extreme as highlighted above. I would also like to point out that sentiment reached an even greater extreme at the 2011 low on the USD/CAD the greatest in over 10 years which suggests that the 2011 bottom is of great significance.

The USDCAD still has some legs to the upside before completing minor wave 1 which is why I would suggests holding to the longs suggested a day or two from the low on this blog.

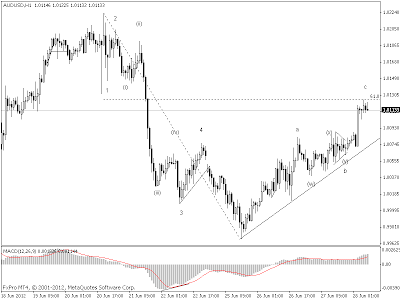

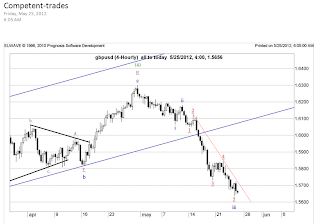

The longer term picture on CABLE is quite clear, as illustrated on a previous post on this blog we have a very significant Fibonnaci time cluster at 2012 which suggests that a significant high will occur this year, I believe it has already occured and the wave (4) triangle is complete a thrust to the downside with a target bellow the 1.35 handle is unfolding.

On a shorter time scale, the GBP/USD has completed minute wave iii and shall witness further lows next week, based on alternation the wave ii unfolded into a zigzag hence we should have some sort of sideways price action before falling into a new low for wave v of minute degree all of which will form wave 1 of minor degree.

I have changed my preferred count on the USD/JPY for several reasons, the first one being that in the diagonal count proposed earlier we have no overlap between wave 1 and 4 which contradicts the weakness that the pattern is suppose to reflect, Another reason for the change in outlook is the extreme bullishness of commercials on the JPY as visible on the COT table bellow.

Now lets looks at some commodity currencies,

The NZDUSD continued its decent as anticipated (Early april was the first post building the bearish case). We are now flirting with the neckline of the head and shoulders pattern talked about in the previous weekend update. The wave strucuture still has some legs before putting in a minor low as illustrated on the short term chart bellow.

Notice the oversold figure on the RSI right as we are testing the neckline I have two counts on this shorter term chart my preffered is the one presented above my alternate is that the wave iii(blue) is complete as of last weeks low, in either case a bounce is expected early next week which shall lead into a sell off that would

penetrate the neckline of the head and shoulders talked about on May 6th.

One of my most exciting calls this year was the one on the USDRUB. Contrary to what is usually the case this pattern is as clear as the skys of july. Infact the very first post on this blog was about the RUB and the Russian stock market, both of which have proven to be extremely accurate, here are a few pictures and comments from the previous posts on russia.

"

As seems evident from the chart posted above, the decline from the wave i(circle) top seems corrective, infact it has broken out of the corrective price channel which signals that the correction is over and the uptrend is back in force. Infact if this count is indeed accurate the upcoming third wave rally shall prove to be a prolonged parabolic explosion. Now what has made me come to such a conclusion? Well several factors.

Factor 1: We had a leading diagonal first wave which signals an extended third wave to come.

Factor 2: Notice how as the wave C of wave ii(circle) made a new low on the price chart it formed what looks similar to a double bottom on the oscillator. Which seems to have been broken to the upside.

Factor 3: An inverse head and shoulders pattern has formed on this 3 hour chart. In an inverse head and shoulders usually the neckline is sloping downwards. However on rare occasion the neckline is sloping upwards, which signal underlying strength in the market. The 'unusual' strength in the market is usually highlighted by a smaller right shoulder relative to the left shoulder which was the case in this particular market. "

Above is the the first chart posted on this blog and here is the result.

That is the beauty of R.N. Elliot's discovery gentleman. Speaking of stock indexes lets take a look at the NASDAQ (considering the hype arround the facebook IPO)

As seems evident the bounce from the '02 lows is corrective which channels perfectly as well. Regardless of its structure which is debatable both legs are almost equal in size and we are comming off fibonacci retracement levels on both logarithmic (which is the appropriate scale in this case) and arithmatic scale. I certainly have to take my hat off for the folks in Facebook, not becuase of what they've built which I think will be alot less valuable in the next 2 years, but for the timing of the IPO. They know its a sellers market and they've sold at the right time, Facebook's investers will not share the same smile as that on Mark Zuckerberg's face as he was ringing the opening bell after making over a billion dollars off of the IPO and you can take my

word on that.

Posted above is the S&P500 E-mini, it seems evident once again that the top called last april was held and primary wave 3(circle) is upon us. A few points to note is that wave (c) is exactly 0.5 the length of wave A (fibonacci ratio) and the april peak occured arround that 1x January trading range reflected off of the high of January. At a clusted as such with price hesitating a top can be called which is

partly what made me go out on the limb and call for a peak in US equities arround the same time Goldman sachs put out a bullish 'generation' call. As for the early May high/lows, they are likely to hold due to the tendency, emphasized seversal times on this blog, of financial markets to remember thier firsts

Regards,

Ahmed Farghaly

P.S. Please view previous weekend update for preffered and alternate counts on both the EUR/USD and USD/CHF (Which are not as clear as the charts presented above)

.png)

.png)

.png)