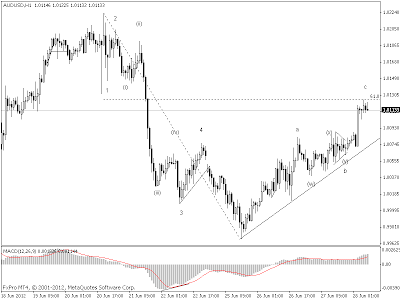

From an Elliott wave perspective it seems evident that the AUDUSD is in the terminal stages of a correction to the upside that started 3 days ago. Confirmation of completion would be a breach of the trendline visible on the chart. Whats even more exciting is how lined up this is with a chart of the S&P Futures chart as visible bellow.

Strong resistance lays at 1330 basis the September contract.

Regards,

Ahmed Farghaly